Metode Menabung Dengan Target Jangka Waktu Tertentu? Duh, kedengerannya serius banget ya? Eits, tapi tenang aja! Nggak seserius itu kok. Bayangin aja, kamu pengen beli motor baru setahun lagi, atau liburan ke Bali tahun depan? Nah, ini dia solusinya! Dengan metode ini, nabung nggak cuma asal-asalan, tapi terarah dan pasti sampai tujuan.

Kita bakal bahas trik-trik jitu supaya impianmu cepet terwujud!

Artikel ini akan membimbingmu untuk merencanakan keuangan dengan tepat, mulai dari menentukan target menabung yang realistis, memilih jenis rekening dan investasi yang sesuai, hingga mengatasi berbagai tantangan yang mungkin muncul di tengah jalan. Kita akan membahas berbagai strategi pengelolaan keuangan pribadi yang efektif, tips praktis untuk mengurangi pengeluaran dan meningkatkan pendapatan, serta aplikasi atau tools yang dapat membantumu memantau keuangan.

Siap-siap wujudkan mimpi finansialmu!

Metode Menabung Berbasis Waktu

Saving up for that dream vacation in Bali? Or maybe a down payment on a sweet ride? Whatever your financial goals, mastering the art of saving with a specific timeframe is key. This isn’t just about stashing cash; it’s about creating a solid financial plan that’s as rad as your ambitions.

Metode Menabung Berdasarkan Jangka Waktu

Different goals call for different saving strategies. Think of it like choosing the right playlist for your workout – you wouldn’t use a chill jazz mix for a hardcore CrossFit session, right? Similarly, short-term goals (like a new phone) need a different approach than long-term ones (like retirement).

- Jangka Pendek (kurang dari 1 tahun): Think high-yield savings accounts or short-term CDs. Easy access to your funds is a plus, but the returns might not be as dazzling.

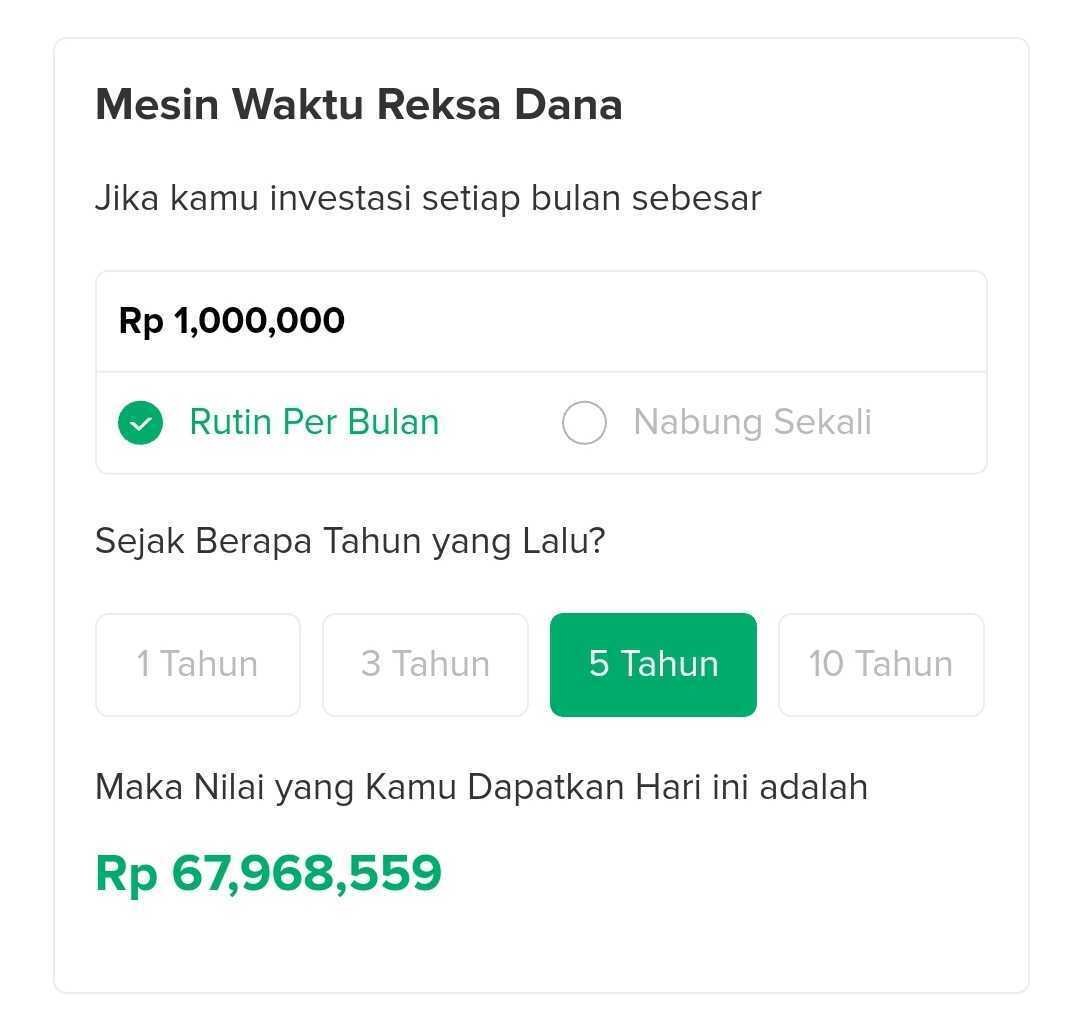

- Jangka Menengah (1-5 tahun): You might consider a mix of savings accounts and slightly riskier investments like index funds. The potential returns are higher, but you’ll need to be a bit more patient.

- Jangka Panjang (lebih dari 5 tahun): This is where you can really level up your savings game. Options like retirement accounts (401(k)s, IRAs), real estate investments, or long-term bonds can offer significant growth potential, but they also come with more risk.

Contoh Perencanaan Menabung untuk Membeli Rumah dalam 5 Tahun

Let’s say you’re aiming for a $300,000 house and need a $60,000 down payment. That’s a seriously ambitious goal! Here’s a simplified example of a monthly savings plan, remember, this is a

-simplified* example and individual circumstances will vary greatly.

| Bulan | Pendapatan | Pengeluaran | Sisa Saldo |

|---|---|---|---|

| 1 | $5000 | $3500 | $1500 |

| 2 | $5000 | $3600 | $3000 |

| 3 | $5000 | $3400 | $4600 |

| … | … | … | … |

Faktor yang Memengaruhi Pemilihan Metode Menabung

Choosing the right saving method depends on your timeframe, risk tolerance, and financial goals. A shorter timeframe means less risk and easier access to funds, while longer timeframes allow for potentially higher returns with higher risk investments.

Langkah-Langkah Menentukan Target Keuangan dan Jangka Waktu yang Realistis

- Define Your “Why”: What are you saving for? The clearer your goal, the more motivated you’ll be.

- Set a Realistic Goal: Be honest about how much you can realistically save each month.

- Determine Your Timeframe: How long will it take to reach your goal? Be realistic and factor in unexpected expenses.

- Choose Your Savings Vehicles: Select the accounts and investments that best suit your timeframe and risk tolerance.

- Stay Consistent: Make saving a regular part of your routine, like brushing your teeth!

Ilustrasi Menabung untuk Pendidikan Anak Selama 18 Tahun

Planning for your child’s college fund is a marathon, not a sprint. You need to account for inflation, which eats away at the purchasing power of your savings over time. Let’s say you estimate college will cost $100,000 in 18 years. You’ll need to factor in a conservative annual inflation rate (say, 3%) to determine how much you need to save each year to reach your goal.

This will require a more complex calculation using a future value formula or a financial calculator.

Strategi Mengelola Keuangan untuk Menabung

Managing your finances effectively is like being the quarterback of your financial team – you need a strategy to score big! This involves a winning combination of smart spending and income boosting moves.

Strategi Pengelolaan Keuangan Pribadi yang Efektif

Effective financial management isn’t rocket science, but it does require discipline and planning. It’s all about balancing your income and expenses to ensure you consistently have money set aside for your savings goals.

- Track Your Spending: Use budgeting apps or spreadsheets to monitor where your money goes. You might be surprised at the little things that add up!

- Create a Budget: Allocate funds for essential expenses (rent, food, utilities), discretionary spending (entertainment, dining out), and, most importantly, savings.

- Automate Savings: Set up automatic transfers from your checking account to your savings account each month. This makes saving effortless.

- Reduce Unnecessary Expenses: Identify areas where you can cut back, such as subscription services you don’t use or daily coffee runs.

- Increase Your Income: Explore opportunities to earn extra money, such as a side hustle or freelance work.

Tips Mengurangi Pengeluaran dan Meningkatkan Pendapatan

Saving more isn’t just about cutting back; it’s also about boosting your income. Think of it as a two-pronged attack on your financial goals.

- Cut the Cord: Ditch cable TV and explore cheaper streaming services.

- Cook More at Home: Eating out less can save you a significant amount of money.

- Find Cheaper Alternatives: Look for discounts and deals on everyday items.

- Negotiate Bills: Contact your service providers (internet, phone, insurance) to negotiate lower rates.

- Explore Side Hustles: Consider freelancing, driving for a ride-sharing service, or selling goods online.

Cara Membuat Anggaran Bulanan

A well-structured budget is your roadmap to financial success. It’s about allocating your income to cover expenses and, crucially, your savings goals. Think of it as your personal financial playbook.

- Track Income: List all sources of income (salary, side hustles, investments).

- List Expenses: Categorize expenses (housing, transportation, food, entertainment).

- Allocate Savings: Dedicate a specific amount to savings each month.

- Monitor and Adjust: Regularly review your budget and make adjustments as needed.

Aplikasi dan Tools Pengelolaan Keuangan Pribadi

Several apps and tools can streamline your financial management. These digital assistants can help you track expenses, create budgets, and even automate savings.

- Mint

- Personal Capital

- YNAB (You Need A Budget)

- EveryDollar

“A penny saved is a penny earned.”

Benjamin Franklin

Jenis Rekening dan Investasi yang Cocok

Choosing the right financial instruments is crucial for maximizing your returns and minimizing risk. It’s like selecting the right tools for a project – you wouldn’t use a hammer to screw in a screw, right?

Jenis Rekening Tabungan dan Investasi

Different accounts and investment vehicles offer various levels of risk and return. Understanding these differences is key to aligning your choices with your savings goals and risk tolerance.

| Jenis Rekening/Investasi | Jangka Waktu Ideal | Tingkat Risiko | Keuntungan |

|---|---|---|---|

| Rekening Tabungan | Pendek | Rendah | Akses mudah, keamanan tinggi |

| Certificate of Deposit (CD) | Menengah | Rendah | Suku bunga tetap, keamanan tinggi |

| Index Funds | Menengah-Panjang | Sedang | Diversifikasi, potensi pertumbuhan tinggi |

| Saham | Panjang | Tinggi | Potensi pertumbuhan tinggi, tetapi juga risiko kerugian tinggi |

Faktor yang Perlu Dipertimbangkan dalam Memilih Rekening atau Investasi

Selecting the right financial product involves careful consideration of your risk tolerance, investment horizon, and financial goals. It’s about finding the sweet spot between risk and reward.

- Risk Tolerance: How much risk are you comfortable taking?

- Investment Horizon: How long do you plan to invest your money?

- Financial Goals: What are you saving for?

Panduan Membuka Rekening Tabungan atau Berinvestasi

Opening a savings account or making an investment is a straightforward process. Most financial institutions offer online and in-person options. It’s advisable to do your research and compare options before making a decision.

Mengatasi Tantangan dalam Menabung

Saving money isn’t always smooth sailing. Life throws curveballs, and unexpected expenses can derail even the best-laid plans. The key is to develop strategies to navigate these challenges and stay on track.

Hambatan Umum dalam Menabung

Many common obstacles can hinder your saving progress. Recognizing these challenges and developing coping mechanisms is crucial for long-term success.

- Pengeluaran Tak Terduga: Car repairs, medical bills, or unexpected home maintenance can quickly deplete your savings.

- Godaan Berbelanja Impulsif: Retail therapy can be tempting, but it can also sabotage your savings goals.

- Kurangnya Disiplin: Sticking to a savings plan requires commitment and discipline.

Solusi Mengatasi Masalah Keuangan

Developing strategies to handle financial setbacks is essential for maintaining momentum. These strategies can help you stay focused and achieve your savings goals despite unexpected challenges.

- Emergency Fund: Having 3-6 months’ worth of living expenses in an easily accessible account can cushion unexpected blows.

- Budgeting Apps: These tools can help you track spending, identify areas for improvement, and stay on budget.

- Financial Counseling: A financial advisor can provide personalized guidance and support.

“Success is not final, failure is not fatal: it is the courage to continue that counts.”

Winston Churchill

Ilustrasi Mengatasi Godaan Belanja Impulsif

Before making a purchase, ask yourself: “Do I really need this? Can I afford it without compromising my savings goals?” If the answer is no, walk away.

Pemantauan dan Evaluasi Kemajuan

Regularly monitoring and evaluating your progress is essential for staying on track and making adjustments as needed. It’s like checking your GPS while driving – you need to ensure you’re heading in the right direction.

Langkah-Langkah Memantau dan Mengevaluasi Kemajuan Menabung, Metode Menabung Dengan Target Jangka Waktu Tertentu

Tracking your financial progress helps you identify areas for improvement and make necessary adjustments to your savings plan.

- Track Transactions: Keep records of all income and expenses.

- Analyze Spending Patterns: Identify areas where you can cut back.

- Review Progress Regularly: Check your savings balance and compare it to your goals.

- Adjust as Needed: Make changes to your plan if necessary.

Contoh Mencatat Transaksi Keuangan dan Menganalisisnya

Use a spreadsheet or budgeting app to track your income and expenses. Categorize your expenses to identify spending patterns and areas for potential savings.

Panduan Melakukan Penyesuaian Rencana Menabung

Life throws curveballs. Be prepared to adjust your savings plan if unexpected expenses arise or your income changes. Flexibility is key to long-term success.

Ilustrasi Grafik Pemantauan Progres Menabung

Imagine a simple line graph. The x-axis represents time (months or years), and the y-axis represents your savings balance. Plot your savings balance each month to visualize your progress and identify any deviations from your plan.

Kesimpulan: Metode Menabung Dengan Target Jangka Waktu Tertentu

Jadi, intinya gini, gaes: menabung dengan target jangka waktu tertentu itu penting banget buat masa depan finansialmu. Nggak perlu mikir rumit, asal konsisten dan disiplin, pasti bisa kok! Pilih metode yang pas sama kondisi keuanganmu, rajin pantau progresnya, dan jangan lupa sesekali kasih reward kecil buat diri sendiri sebagai bentuk apresiasi. Yuk, mulai nabung sekarang juga dan rasakan sensasi mewujudkan impianmu sendiri!